Chancellor Kwasi Kwarteng revealed the Government’s Growth Plan this morning setting out “a new approach for this new era.”

The Growth Plan focuses on:

- Reforming the supply-side of the economy

- Maintaining the responsible approach to public finances

- Cutting taxes to boost growth

The Growth Plan aims to tackle energy costs, bring down inflation, back businesses and help households. The plan has set a target for a 2.5% trend of growth, securing sustainable funding for public services and improving living standards across the country. This will be achieved by:

- Cancelling corporation tax increases

- Cutting Income Tax to 19% in April 2023

- Cutting Stamp Duty

- Reversing the 1.25% rise in National Insurance contributions

Chancellor Kwarteng outlined specific support for pubs and the hospitality sector, namely freezing alcohol duty for another year. Reforms to modernise alcohol duties will be published in due course and the Government remains confident that this, combined with the Energy Bill Relief Scheme, will protect businesses from soaring costs this winter. He continued by announcing that new measures to unlock private investment, such as incentivising investment, would further support businesses in the U.K.

During his speech the Chancellor also announced major tax reforms that aim to allow businesses to keep more of their own money, encouraging investment, boosting productivity and creating jobs. He continued by assuring that the Annual Investment Allowance will permanently remain at £1 million, rather than the proposed reduction to £200,00 in March 2023.

Kwarteng continued by announcing that the Government is in discussions with 38 local and mayoral combined authority areas in England, to set up Investment Zones in specific sites. Each Investment Zone will offer generous, targeted and time limited tax cuts for businesses and liberalised planning rules to release more land for housing and commercial development.

The Chancellor continued by recognising the need “to encourage people to join the labour market” noting that there are currently “more vacancies than unemployed people to fill them.” As such, Universal Credit claimants who earn less than the equivalent of 15 hours a week at National Living Wage will be required to meet regularly with their Work Coach and take active steps to increase their earnings or face having their benefits reduced. This change is expected to bring an additional 120,000 people into the more intensive work search regime.

The majority of announcements today are UK-wide, however the Scottish Government is expected to receive more than £600 million extra funding over the 2021 Spending Review period as a result of the changes to income tax and Stamp Duty Land Tax and the Welsh Government will receive around £70 million over the same period as a result of the change to Stamp Duty Land Tax. The reversal of the Health and Social Care Levy will save 4.3 million people across Scotland, Wales and Northern Ireland more than £230 on average next year.

You can read the Government’s press release for on the Growth Plan here. You can read the Growth Plan in full here and you can stay up to date with other news here.

Featured Training

Featured Training

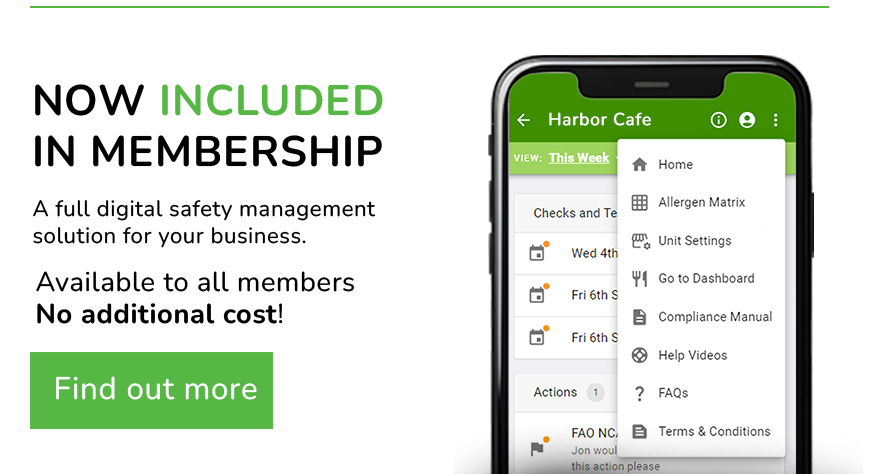

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails