The UK Government has issued an update on guidance for drivers that use HGVs, vans or trailers to transport goods between two points in the EU, Iceland, Liechtenstein and Norway.

The update includes added information that serves to clarify how the same rules also apply to EU operators that are carrying out cabotage or cross-trade jobs in the UK.

The guidance stipulates that companies are required to make a ‘posting declaration’ when drivers use HGVs, vans or trailers to transport goods between two points in the EU, Iceland, Leichtenstein and Norway.

They must also now follow this process when carrying out similar transportation jobs throughout the UK. This also includes journeys that are made inside Ireland and does apply if you are a Northern Ireland vehicle operator.

The details of such transportation must be declared online on an EU portal – you need to create an account before you can declare a journey. This declaration of details is known as making a ‘posting declaration’ – it is worth noting there are no fees involved in making this kind of declaration.

The types of journeys you must declare include:

- Cabotage jobs (loading goods in one of these countries and unloading them at another point in the same country using a UK-registered vehicle)

- Cross-trade jobs (loading goods in one of these countries and unloading them in another of these countries using a UK-registered vehicle)

- Moving goods for your own business’ use inside these countries, including if your business is not mainly about moving goods

Furthermore, declarations must be made when using any of the following vehicles to transport goods:

- Heavy goods vehicles (HGVs)

- HGVs towing trailers

- Vans of any size or other light goods vehicles (sometimes called ‘light commercial vehicles’)

- Vans towing trailers

- Cars towing trailers

To read the Government update in full click here. To keep up to date with relevant industry updates click here.

Featured Training

Featured Training

OUR MEMBERSHIP

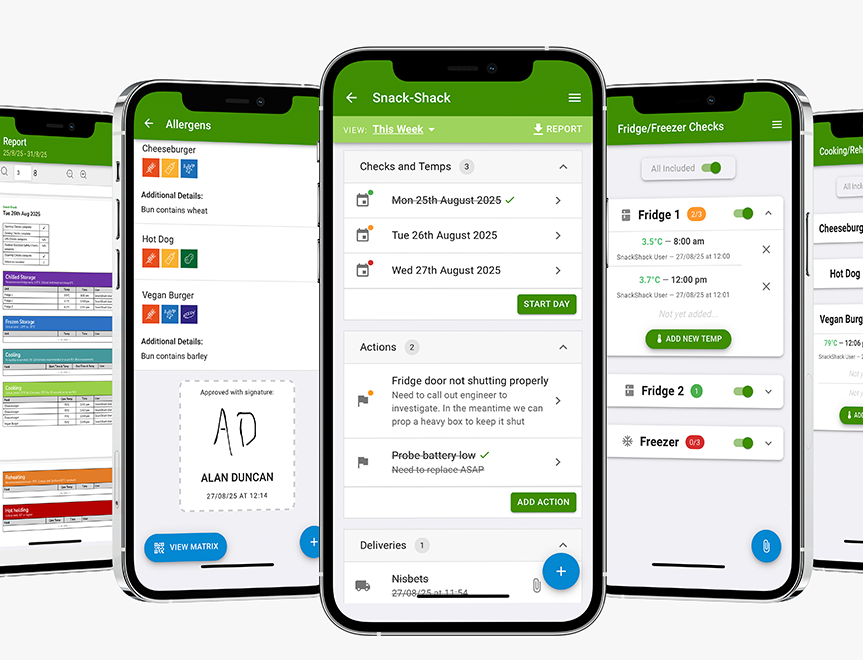

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails