Last week, the UK Chancellor Rachel Reeves shared the first budget under the Labour government. There’s a lot of information within the Chancellor’s address to Parliament, and the following list are some of the key changes for hospitality.

You can read the full UK Autumn budget on the GOV website.

1.2% increase to National Insurance contributions

From April 2025, there will be an increase to the amount of Employer National Insurance (NI) contributions an employer must make. NI Contributions will increase from 13.8% (currently) to a total of 15%, and the National Insurance primary threshold – which is when employers begin to pay NI on an employee’s salary, will be lowered from £9,100 to £5,000. Finally as a measure to help small businesses absorb the above tax rises, from April 2025 the government have increased the employment allowance for eligible businesses from £5,000 to £10,500 (which is the amount you can reduce your employers’ NI liability each tax year).

Changes to the minimum wage

The National Living Wage for workers over 21 will increase by 6.7% in April 2025 to £12.21 per hour, which is worth an extra £1,100 per year for a full-time worker. Meanwhile the National Minimum Wage for 18 to 20-year-olds will go up by 16% to £10 per hour.

Update on business rates

The current 75% discount on business rates is set to expire in April 2025, this will be replaced by a discount of 40% (maximum discount of £110k). In addition there is a plan to introduce permanently lower business rates for high-street retail, hospitality and leisure properties from 2026-27.

Capital Gains Tax

Capital Gains tax rates for disposal on or after 30 October 2024 will increase from 10% to 18% and the higher rate from 20% to 24%. The rate for Business Asset Disposal Relief (currently at 10%) will increase to 14% from 6 April 2025, and will increase again to match the lower main rate at 18% from 6 April 2026.

HMRC changes

The interest rate applied will increase on tax that is overdue to encourage prompt payment, in addition there will be an increase in HMRC criminal investigation work by hiring more compliance officers.

Making Tax Digital update

There was a Making Tax Digital (MTD) update within the budget, and the Labour government reiterated its commitment to delivering on the current timeline and expanding the rollout for businesses with an income over £20,000 per year.

Conclusion

We hope you found this useful, and if there is anything within this summary you would like support with then please contact The Catering Accounting Company at [email protected]

Featured Training

Featured Training

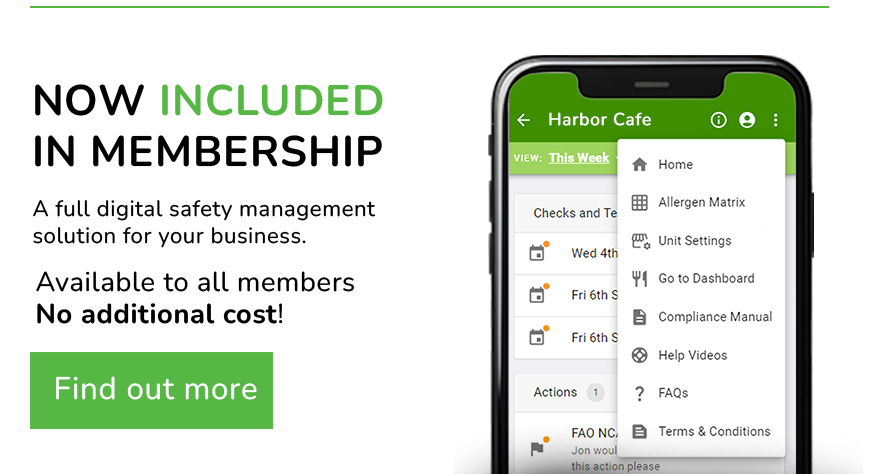

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails