The Office for National Statistics (ONS) has announced that UK inflation, as measured by the consumer prices index, has risen from 9% in April to 9.1% in May, a level unseen since 1982. This has put UK inflation at the highest amongst the G7 (an inter-governmental political forum consisting of Canada, France, Germany, Italy, Japan, the US and the UK).

Several factors, such as increased fuel and energy prices, have contributed to growing inflation and the ONS states that rising food costs have further exacerbated the issue. Furthermore, Government borrowing was higher than expected in May, as inflation sent interest payments on the UK’s debt to a monthly record. Subsequently, economists are warning that the increase in debts, coupled with the UK’s slowing economy, is likely to pushing government borrowing to higher than the Office for Budget Responsibility (OBR) predicted.

Fears continue to grow that the UK is headed for a recession as both high inflation and a slowdown in new orders for UK firms, indicate that the economy is ‘running on empty.’ The cost-of-living crisis has forced consumer to cut back on spending and this has caused a reduction in demand across many businesses.

Chief business economist at S&P Global Market Intelligence, Chris Williamson said:

“While there are some signs that the inflation could soon peak, the […] data suggest[s] the rate of inflation will […] remain historically high for some time to come, indicating that the UK looks set for a troubling combination of recession and elevated inflation as we move into the second half of the year.”

The Bank of England has warned that inflation will rise to above 11% by October this year. They also emphasise that inflation cannot be blamed solely on global factors and highlight certain domestic factors, such as a tight labour market, as having played a significant role; though they predict that the government’s Cost of Living Support package will help to mitigate some issues. Nevertheless, the government is discouraging employers from handing out large salary increases over fears that this will result in an ‘inflationary spiral,’ as seen in the 1970s.

The Bank of England remains confident that inflation will slow down next year and be close to the consistent 2% target in approximately 2 years.

You can read more on the Bank of England’s forecast here and stay up to date with other news here.

Featured Training

Featured Training

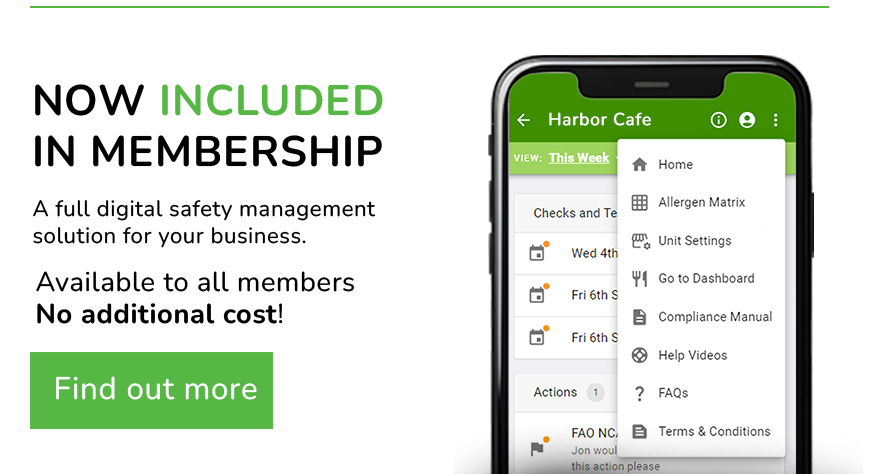

OUR MEMBERSHIP

We're here to help make your catering business a success. Whether that be starting up or getting on top of your compliance and marketing. We're here to help you succeed.

Want our latest content?

Subscribe to our mailing list and get weekly insights, resources and articles for free

Get the emails